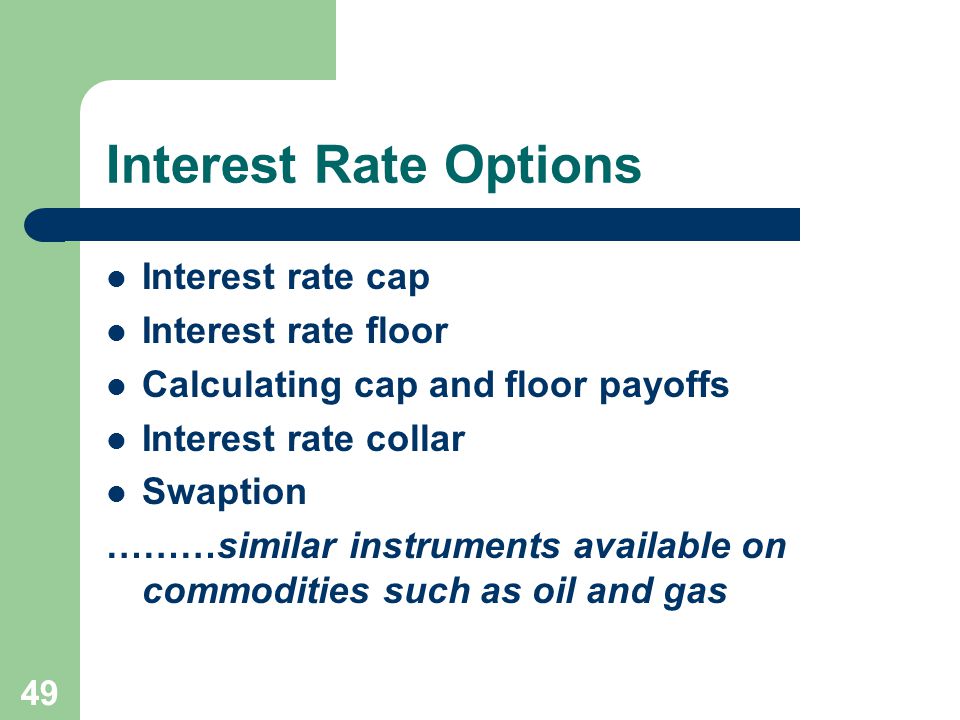

Cap Floor Collar Options

/GettyImages-508210587-035f69f0bb23424287d09c3a93bf4735.jpg)

It is a type of positive carry collar that is constructed by simultaneously purchasing and selling of out of the money calls and puts with the strike prices of which creating a band encircled by an upper and lower bound.

Cap floor collar options. The puts and the calls are both out of the money options having the same expiration month and must be equal in number of contracts. A barrower may want to limit the interest rate to avoid any rises in the future and buys a cap. In other words the. An option based strategy that is designed to establish a costless position and secure a return.

This organization has purchased a 5 cap and sold a 2 floor which provides the organization with an interest rate collar of 2 to 5. A collar is an options trading strategy that is constructed by holding shares of the underlying stock while simultaneously buying protective puts and selling call options against that holding. Or investor may buy a floor to avoid any future falls in the interest rates. Interest rate caps floors and collars these option products can be used to establish maximum cap or minimum floor rates or a combination of the two which is referred to as a collar structure.

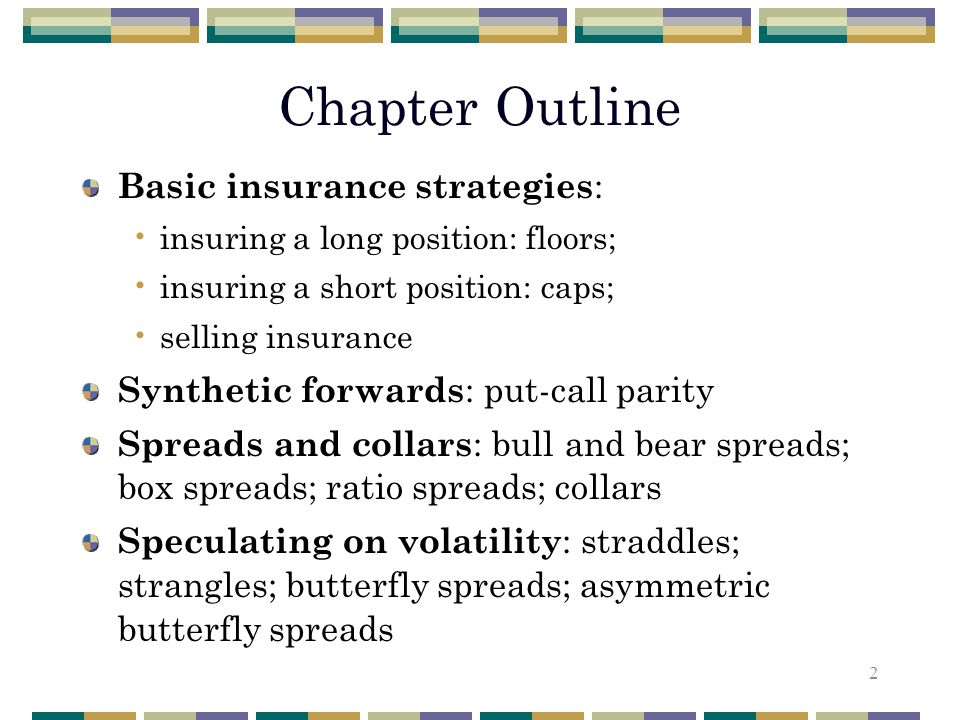

These products are used by investors and borrowers alike to hedge against adverse interest rate movements. An interest rate collar is an options strategy that limits one s interest rate risk exposure. Caps floors and collars are option based interest rate risk management products that put limits to the interest rates. Establishing a floor and a cap on interest rates.

Cap floor and collar options on forex 03 03 2015 by forexderivatives bookmark the permalink. Education general dictionary. Start studying chapter 23 options caps floors and collars. Interest rate swap in hedging variable rate debt with a swap an organization agrees to pay out a fixed amount each month to a counterparty in exchange for receipt of a variable rate.

Cap is the whole list of options giving to the buyer opportunity to pay on the credit a market rate no more than an execution rate. Caps floors and collars 1 caps floors and collars caps capped floaters inverse floaters with 0 floor floors floaters with floors collars floaters with collars strike rate settlement frequency index notional amount calls on yields puts on yields portfolio of options concepts and buzzwords reading.

:max_bytes(150000):strip_icc()/strategy-4086857_19201-23485cf7c4bf4dbbb95c93f267285f16.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Zero_Cost_Collar_Apr_2020-01-3f7ffff9ccd84d9e8f93fa3cd72c8d4f.jpg)

/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)